Have questions on the Duval County Public Schools tax referendum? We have answers.

5/17/2019

On May 7, the Duval County School Board voted to approve a resolution seeking a special election on Nov. 5, 2019, to ask voters to support a half-cent sales tax over 15 years to pay for a $2 billion plan to upgrade our school buildings. The issue now goes to City Council, who will consider whether and when the question goes to voters. The Jacksonville Public Education Fund has been following the issue closely, and we’ll keep you updated here and on Facebook and Twitter as more information becomes available. You can also learn more at on the Duval County Public Schools' tax referendum website, ourduvalschools.org.

Issue briefing (5 min)

Q&A with Duval County School Board Chair Lori Hershey (25 min)

Why are our public school buildings in need of such costly repairs?

-

Duval County Public Schools (DCPS) has the oldest school buildings in Florida. Many were built more than 50 years ago; and they’re no longer suited for the way children learn today. Meanwhile, the cost of maintaining them continues to increase as they get older, in some cases taking away funding from other areas of need.

-

Funding from the state has been decreasing over the years, and therefore, DCPS hasn’t been able to accommodate the demand for building upgrades. Duval County is the only county in Florida that doesn’t collect any local funding beyond property taxes. Other counties have impact fees or sales taxes to support schools, especially school buildings.

When would the vote take place?

-

The School Board voted on May 7 to seek a vote through a special election on Nov. 5, 2019. The Supervisor of Elections has said it's now too late to organize an election in early November. The School Board is now advocating for a December vote.

How can I make my voice heard on City Council?

- City Council held a public hearing on June 11, with almost 70 members of the public speaking on the tax referendum, the vast majority in favor.

- On Tuesday, June 18, the City Council's finance committee voted to move the date back to the general election in 2020. Later that day, the rules committee voted to defer it to the next City Council, which is installed on July 1.

- Community members can call or email their representatives on City Council, including their district representative, at-large members, and Council President Scott Wilson. You can find contact information for City Council here.

- Community members can share their views via a letter to the editor of the Florida Times-Union or the Folio Weekly.

What do voters think about a tax increase to fund public schools?

-

The Jacksonville Public Education Fund’s annual poll has shown year over year that Jacksonville residents would be willing to approve a small tax increase in support of our schools. In this year’s poll, 78.5 percent of respondents said they would support a small tax increase for school facilities.

- In June, the UNF Public Opinion Research Lab did another poll specifically of registered voters and found similar overwhelming support for the proposed half-cent tax increase: 75 percent of voters overall and on both sides of the aisle - Democrats supported the tax at 86 percent, and Republicans at 60 percent.

-

Many other districts around the state of Florida have pursued similar tax referenda, and voters have overwhelmingly supported them.

What does the tax referendum have to do with the district’s facilities master plan?

-

This spring, a consultant shared a draft facilities master plan at several community meetings around Duval County. The $2 billion plan would impact every school in the district - including upgrades to schools, the construction of new schools, and the consolidation of some schools where the student population has declined over the years.

-

The district has communicated that these plans are not final and they have continued seeking feedback from the community, , especially in Districts 4 and 5 in North and West Jacksonville, which have the oldest schools in the county and require the most upgrades.

-

The tax referendum would help fund this plan, but the vote wouldn’t be on the facilities plan itself. The School Board will vote on the final facilities plan this summer. What residents will decide is whether we will contribute a half-cent sales tax to fund the plan. If you have input on the facilities plan, you should reach out to your representative on the School Board. You can find out which School Board member represents your school on this list.

Could we use a half-cent sales tax to pay for expenses other than public school buildings, such as teacher salaries?

-

The law restricts the way the district can spend the revenue from a half-cent sales tax; it’s only possible to spend it on capital infrastructure.

-

The advantage of sales tax funding is it essentially raises more funds because it can be approved once for a longer period than other funding sources.

-

It’s possible that the sales tax could benefit teacher salaries indirectly. Right now, the district is spending huge amounts to maintain old school buildings. The facilities master plan, and the tax increase to fund it, would allow the district to do significant upgrades and build new schools, reducing the cost of building maintenance. The savings could go toward other expenses, such as teacher salaries. We haven’t heard yet if this is part of the strategy.

What other funding sources could we pursue for public schools?

-

Alternative funding sources, such as a millage (property tax) increase, could be used for other purposes, including increasing teacher salaries. For example, St. Lucie just passed a millage increase to fund school safety and teacher salaries in April through a special election by mail. The election had record high turnout.

-

The limitation of millage increases is that they are only valid for four years, so the district would have to go back to voters every four years to ask them to re-approve the increase.

Would the revenue be used only for district schools or would it also pay for facilities in public charter schools?

-

The School Board discussed this and decided to include charter schools in the resolution.

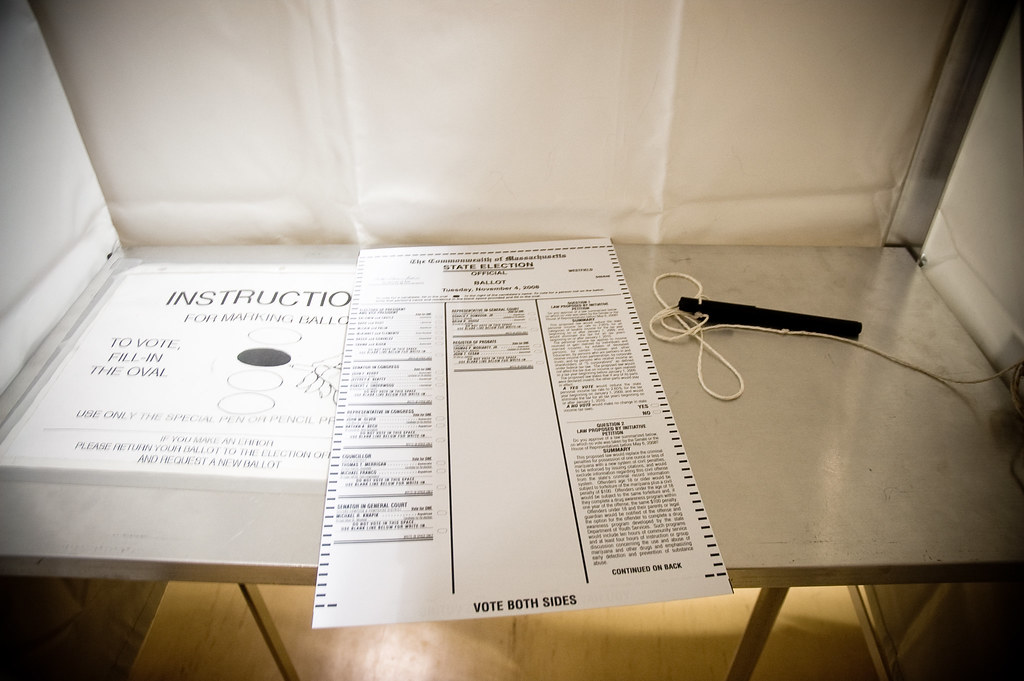

Photo credit: Heather Katsoulis via Flickr